MOTOR VEHICLE ACCIDENT (MVA)

MOTOR VEHICLE ACCIDENT (MVA)

Motor vehicle accidents can occur when we least expect them, leading to physical injuries, property damage, and emotional distress. While it’s impossible to predict when an accident will happen, having the right insurance coverage can provide much-needed financial protection and peace of mind. Motor Vehicle Accident (MVA) insurance is specifically designed to support individuals and families in the aftermath of an unfortunate collision, ensuring that they can focus on recovery instead of worrying about the associated costs. Let’s explore how MVA insurance can help safeguard you during challenging times.

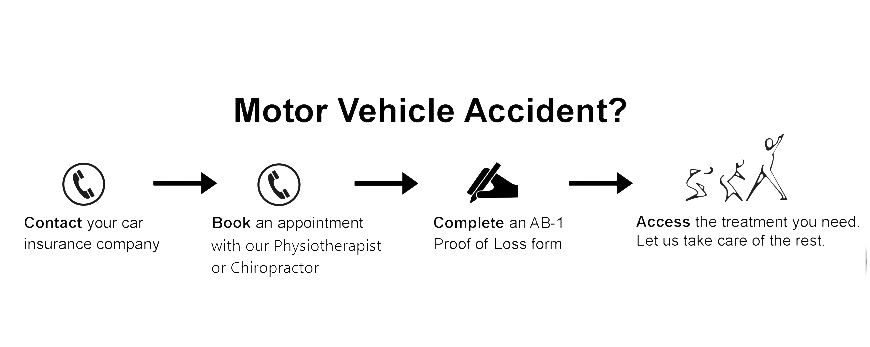

How Does MVA Insurance work ?

MVA insurance offers comprehensive coverage for a wide range of motor vehicle accidents, including collisions involving cars, motorcycles, trucks, and other vehicles. Whether you’re the driver, passenger, or pedestrian involved in an accident, this insurance can assist you in managing medical expenses, property repairs, and legal fees, depending on the specific terms and conditions of your policy.

Benefits ?

One of the most critical aspects of MVA insurance is its ability to cover medical expenses resulting from accidents. From emergency room visits and surgeries to rehabilitation and physical therapy, the financial burden of injuries can quickly escalate. MVA insurance

steps in to provide coverage for these costs, ensuring that you receive the necessary medical attention without worrying about the expenses involved.

Conclusion

Motor Vehicle Accident (MVA) insurance offers crucial protection and support for individuals and families affected by motor vehicle accidents. By providing coverage for medical expenses, property damage, legal assistance, and more, MVA insurance ensures that you can recover without the added burden of financial strain. Don’t leave your well-being and future to chance—invest in MVA insurance to safeguard yourself and your loved ones when it matters most.

Get Coverage for You Today.